No. 1 Online Pay Stub Generator

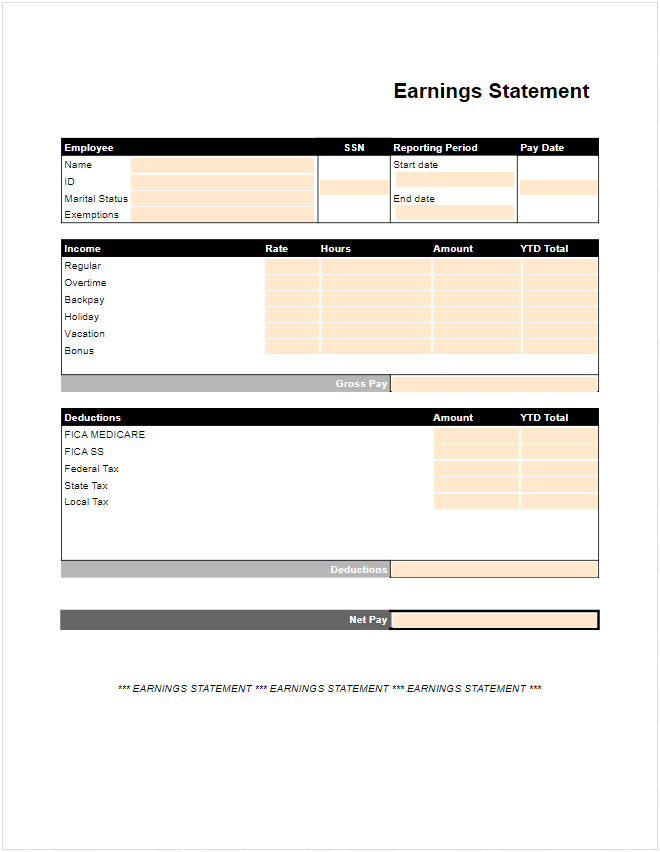

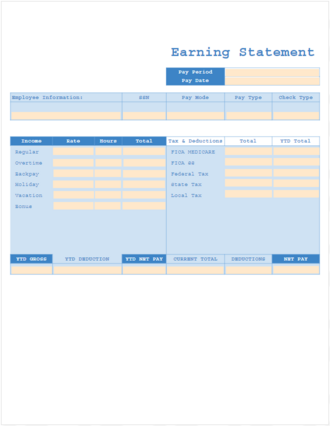

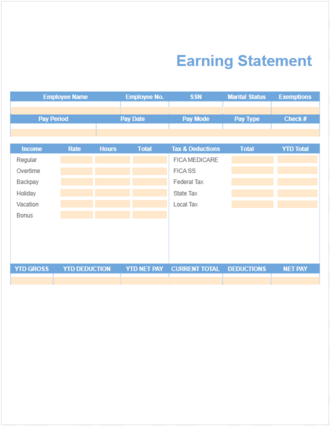

Quick Start: Select a template

Easy-to-use Instant Pay Stub and Payslip Maker

We offer the simplest, safest, and fastest way to create a pay stub for businesses.

100% Safe and Secure System

Your information is kept confidential.

Accurate Calculations

Our pay stub generator accurately calculates taxes automatically.

Create Multiple Pay Stubs

Generate as many pay stubs as needed.

Download and Print in PDF

Export your pay stub in ready-to-print PDF.

How to Create a Pay Stub

Create a Pay Stub in 3 Easy Steps!

- Step 1: Enter details and information

- Step 2: Preview your pay stub

- Step 3: Download and print in PDF

Who can use PayStub-Generator.org?

Whether you’re a start-up business owner or a seasoned employer, we have the right tools and systems to help you with your payroll.

Employers

PayStub-Generator.org is ideal for employers who manage payroll by themselves. With an easy-to-use interface, employers can create pay stubs online. Employers can download pay stubs in PDF or email them to their employees, freelancers, or contractors.

Business Owners

Business owners who manage their own business and pay themselves may use PayStub-Generator.org to create simple payslip. With just 3 easy steps, business owners can generate professional payslips that can be used as proof of income.

Why Choose PayStub-Generator.org?

You no longer need expensive software to prepare pay stubs anymore.

PayStubGenerator.org is a new, web-based way to do just that. It requires no installation and works with any modern internet browser.

FAQ: What is a Pay Stub?

A pay stub, payslip, or paycheck stub, is a document that an employer attaches to an employee’s paycheck on payday. It contains information about an employee’s compensation, itemizing the wages earned for a pay period and year-to-date payroll. Pay stub also typically includes information about any deductions from an employee’s pay, such as taxes, insurance premiums, and retirement contributions. For hourly workers, a pay stub may also list the number of hours worked in a pay period.

While pay stubs are not required by law in the United States, they can be helpful for employees to keep track of their earnings and deductions. Pay stubs can also be useful for employers, providing a record of wages paid and deductions withheld. A pay stub can be paper or electronic, and it may be provided to an employee in physical form or sent electronically. For example, some employers send pay stubs via email on payday, while others make them available through an online portal.

Pay stubs typically contain the following information:

- Employee name and address

- Employer name and address

- Social Security number or employee ID number

- Date of pay period

- Start and end date of pay period

- Total hours worked during pay period

- Hourly pay rate or salary amount

- Gross pay (total wages earned before deductions)

- Deductions from pay, such as taxes, health insurance, and retirement contributions

- Net pay (total wages after deductions)

- Method of payment (e.g., direct deposit or check)

Paystub-generator.org is an online PDF reader, editor & form filler

A new way to open and edit PDF files online, Paystub-generator.org frees users from the regular software requirements for using the de facto document file format and installation. Completely web-based, Paystub-generator.org requires no more than a modern internet browser and an active internet connection.

Copyright © 2022 paystub-generator.org All Rights Reserved.