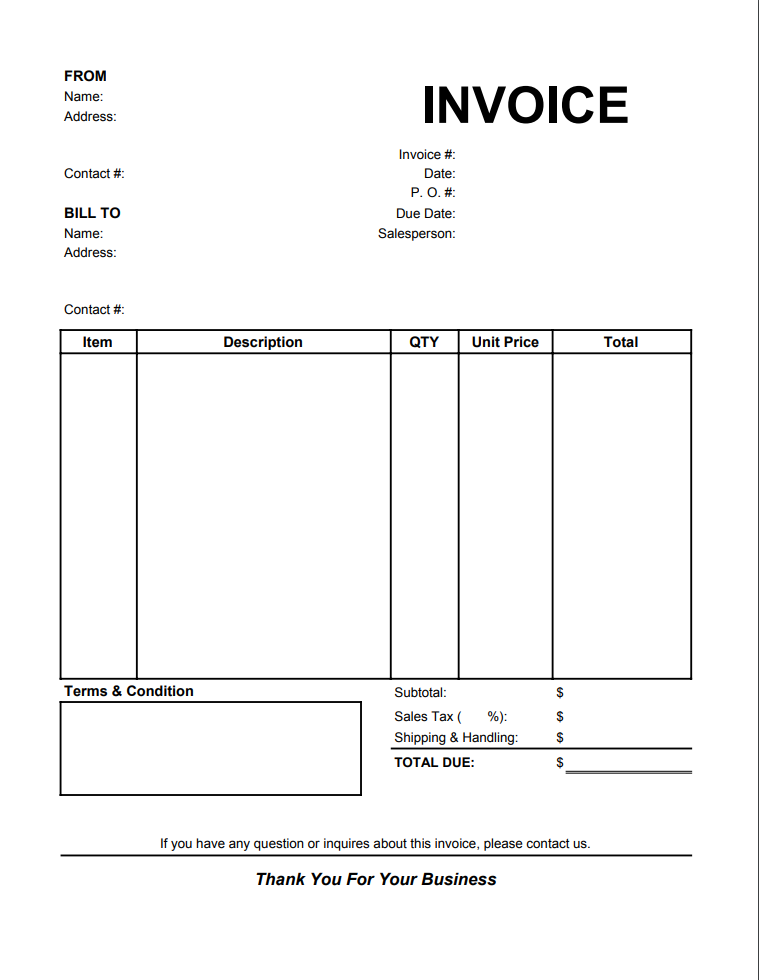

This Invoice is used when billing another for goods or services received. This invoice sets out the name of the company, invoice number, tax ID number, to whom the invoice is being sent and invoice amount.

An invoice has the following parts:

- First of all, we’ve got the names and addresses of the buyer and the seller.

- And on the other side Invoice Number. This is a unique number that identifies the Invoice.

- Usually, Invoice numbers are sequential, so the next invoice raised by a company would most likely be the present number + 1.

- Below that the Invoice Date. This is the date that the Invoice was created and it’s critical to include it because it starts the count down for when the payment is due from the Buyer.

- And how long have they got? That’s determined by the Sale Terms, so the whole payment is due within what is written on the Sale Terms of the Invoice date.

- Next, the description of the Goods and Services that this Invoice relates to. It’s best to be as specific as possible in the Invoice description because you don’t want to cause any confusion and delay that payment.

- To the right of the description, we have the Quantity, Rate, and Amount.

When should I Invoice?

- Invoices are most commonly sent out after Goods and Services have been provided, however, they can also get sent out before depending on what’s been agreed between the two parties. However, Accounting treatment in each situation is different.

Are Invoices and Sales Receipts the same thing?

- The short answer is no. However, this is confusing because there are a few similarities. Both serve as evidence of a transaction. And both are produced by the Seller and are given to the Buyer. However, the key difference is that an Invoice is a request for payment, so it is issued before the payment has been made whereas a Receipt, that’s issued after.

What’s the difference between A Sales Invoice and a Supplier or Purchase Invoice?

- Well, they are actually the same thing. They are both Invoices. The difference in their names depends on your perspective. If you’re the Seller then you’d call it the Sales Invoice. And if you’re the Buyer then you’d call it a Supplier or a Purchase Invoice.

Is an Invoice legally binding?

- In general, no they’re not. An invoice by itself isn’t legally binding. If they were then what would stop you from just making all the money by just firing out invoices out to whoever you want. In order for them to become legally binding both the Buyer and Seller have to agree on the terms. I can’t speak for the specifics of your country, but in general it’s important that both sides have evidence of the agreement at least in email, or better yet in a signed contract. You don’t want to be that person that get’s in the situation where the client or customer is refusing to pay.

Related Forms:

Other Forms

- Affidavit Forms

- Assignment Forms

- Attorney Forms

- Bankruptcy Forms

- Bill of Sales Forms

- Borrow, Lend & Collection Forms

- Business Forms

- Confidentially Forms

- Contract Forms

- Copyright Forms

- Corporation Forms

- Credit Form

- Declaration Form

- Deed Forms

- Divorce Forms

- Employment Forms

- Entertainment Contract Forms

- Family Law Forms

- Free Will Forms

- Government Form

- Health Care Forms

- Homestead Form

- Indemnity Agreement Form

- Intellectual Property Forms

- Internet Forms

- Landlord and Tenant Forms

- Lease and Rental Forms

- Letter Forms

- Limited Liability Co. Form

- Non-Compete Forms

- Non-Disclosure Forms

- Notice Forms

- Parental Permission Forms

- Partnership Forms

- Power of Attorney Forms

- Premarital Forms

- Promissory Notes

- Real State Forms

- Release Forms

- Sale & Purchase Forms

- Technology Forms

- Trademarks Forms

- UCC Forms

5/5

0

Downloads

"Formscatalog.com is my go-to-site for my templates and document needs."

Charles T. Bachman

Lawyer